Share This Article

Budgeting feels like torture for most people. You try to track every coffee purchase, feel guilty about going out to eat, and eventually give up when real life gets messy. Here’s a different way that doesn’t require you to become an accountant or give up everything you enjoy.

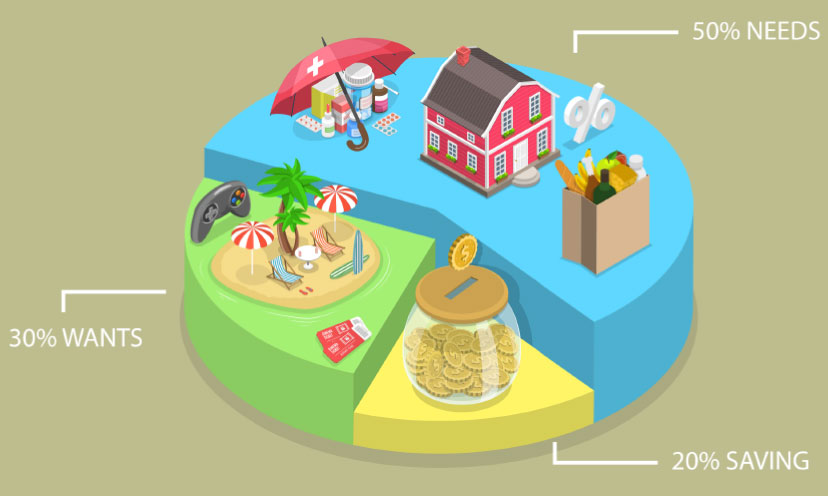

The 50/30/20 rule is basically budgeting for people who hate budgeting. Instead of tracking 15 different categories or writing down every expense, you just split your money into three simple buckets. That’s it.

How It Works

After you pay taxes and anything else deducted from your paycheck, you divide your leftover money like this:

- 50% goes to stuff you absolutely need

- 30% goes to stuff you want but don’t need

- 20% goes to saving money and paying off debt

Let’s say you bring home $3,000 every month after taxes. You’d spend $1,500 on needs, $900 on wants, and put $600 toward savings and debt. Simple math, no complicated tracking required.

The 50%: Things You Actually Need

This covers the basics you can’t really avoid: rent, groceries, car payment, insurance, phone bill, minimum payments on credit cards, and utilities. These are the bills that show up whether you like it or not.

Notice I said “minimum payments” on credit cards. You’re not trying to pay off all your debt with this 50%. You’re just keeping the lights on and staying current on everything.

If your needs take up more than 50% of your income, don’t panic. Lots of people start there, especially if you live somewhere expensive or had some financial setbacks. The goal is to work toward 50% over time.

The 30%: Fun Money

This is money for things that make life worth living but won’t ruin your life if you skip them. Eating out, Netflix, new clothes, hobbies, going to movies, buying coffee, gym memberships, vacations.

Here’s what’s different about this approach: you get to spend 30% of your income on whatever you want without feeling guilty about it. Most budgets make you feel bad about spending any money on yourself. This one builds in fun money from the start.

Using our $3,000 example, that’s $900 a month you can spend however you want. That’s $30 a day for coffee, lunch, entertainment, or whatever makes you happy. Not too shabby.

The 20%: Your Future Self

This chunk goes toward making your financial life better over time. It includes:

- Building up an emergency fund (start with $1,000, then work toward 3-6 months of expenses)

- Putting extra money toward credit card debt or loans

- Saving for retirement in a 401(k) or IRA

- Saving for big goals like a house down payment or new car

If you’ve never saved 20% of your income before, this might seem impossible. Start with 10% or even 5%. The important thing is starting somewhere and building the habit.

Making It Work in Real Life

Real life is messier than neat percentages, and that’s okay. This system gives you guidelines, not handcuffs.

If your needs are over 50%: Look for ways to cut the big expenses. Can you get a cheaper phone plan? Move somewhere less expensive? Get a roommate? Refinance your car loan? Sometimes you really have to increase your income instead of cutting expenses.

If you blow through your 30% want money: Try putting that money in a separate checking account or getting cash for the month. When it’s gone, you’re done spending on wants until next month. Or use apps like PocketGuard that send you alerts when you’re getting close to your limit.

If you can’t save 20%: Start smaller. Save 5% or even 1% and increase it by 1% every few months. Something is better than nothing, and you can build up to 20% over time.

Setting It Up So You Don’t Have to Think About It

The best budget is one you don’t have to manage every day. Here’s how to make this system run itself:

Use separate accounts. When your paycheck hits, automatically split it into three accounts: checking for needs, savings for your 20%, and maybe a separate checking account for wants. Many banks let you split direct deposit, or you can set up automatic transfers.

Pay yourself first. Move your 20% savings money out of your checking account immediately when you get paid, before you can spend it on other things. Treat saving like any other bill that has to be paid.

Check in weekly, not daily. You don’t need to track every purchase. Just look at your accounts once a week to see how you’re doing. Are you spending too much on wants? Are you staying on track with needs? Adjust as you go.

Why This Actually Works

Most budgets fail because they’re too complicated or too restrictive. This system works because:

It’s simple. Three categories instead of 20. You can do this math in your head.

It builds in fun. You’re not trying to cut out everything you enjoy. You’re just putting limits on it.

It’s flexible. Some months you might spend more on needs because your car breaks down. Other months you might save extra because you stayed home more. Life happens.

It focuses on the big picture. Instead of tracking every dollar, you’re making sure the important stuff gets covered: paying bills, saving money, and enjoying life.

Getting Started

- Figure out your after-tax income. Look at what actually hits your checking account every month.

- Add up your needs. Rent, groceries, minimum payments, insurance, utilities, phone. See how close you are to 50%.

- Set up automatic savings. Even if it’s just $50 a month to start. Most banks will do this for free.

- Give yourself permission to spend on wants. If you’ve been feeling guilty about buying coffee or going out to eat, stop. You’ve budgeted for it.

- Track loosely for a month. You don’t need fancy apps or spreadsheets. Just check your accounts weekly and see how you’re doing.

Remember, the goal isn’t to follow this system perfectly forever. It’s to get comfortable managing money without stress or guilt. Once you’ve done this for a few months, you’ll have a much better sense of where your money goes and what adjustments make sense for your life.

The 50/30/20 rule won’t solve every money problem, but it will give you a foundation that’s way better than winging it or feeling guilty about every purchase. And honestly, that’s a pretty good place to start.